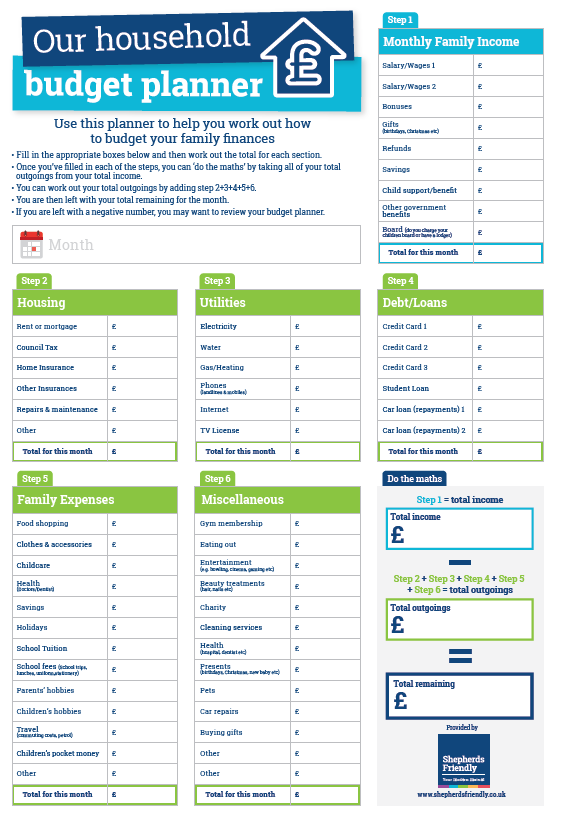

With this information at hand, it will be easier to develop a budget that covers all household essentials, while allocating money for discretionary spending such as charitable donations and recreation. The calculator will then figure estimates according to the general percentage values associated with a workable family budget. A family budget template is a pre-made solution to help you categorize and analyze your family finances for a certain period, such as a month, quarter. The calculator can be used to create either a monthly budget, or an annual budget buy simply entering the net income value in the appropriate field.

#FAMILY BUDGET PLANNER FREE#

The free Budget Planning Calculator will help families better understand where their money is going, and create a budget that works for their financial situation. Those with higher incomes should be better able to balance their debt to savings ration, while those with lower incomes may find saving more difficult. house Here are suggested percentage guidelines based on net income. Again, these percentages will be greatly influenced by the family income. Home Free Monthly Personal Budget Planner.

Join Prime to save 3.00 more on this item. Where more money is devoted to debt removal, less can be devoted to savings. Budget Planner - Budget Book 5.3' x 7.6', 12 Months Financial Organizer, Expense Tracker, Monthly Budget Book with Pockets for Each Month, Undated Finance Planner & Accounts Book, Magnetic Hardcover. Savings and DebtĪ family's ability to save money is in direct proportion to their outstanding debt. Still, that being said, some general percentage values can be applied as general rules of thumb to help families build a better budget. Likewise transportation costs will rise or fall depending on the size of the family, and general work habits. Annual medial costs will largely depend on the size and the health concerns of the family. Secondary budgetary considerations, such as medical expenses, transportation and recreational spending, are more difficult to gauge. Alternatively, families with a higher income should find that the percentage of their household budget devoted to necessities is lower, and that more money is available for savings, personal expenses and charitable donations. Families with a limited income will find that their monthly and annual household necessities take up a large portion of their budget, and there will likely be less money left over for savings and discretionary spending. Depending on income, the percentage of the budget set aside for a family's necessities may be higher or lower.

Necessities, like housing, utilities, food and clothing, typically make up the bulk of the family budget and are easier to plan for. This free tool will help you to see where your money is going, and how you can save for the future. But creating a family budget can be made easier with the Budget Planning Calculator. How much is spent each month on transportation? How much on clothing, health care, recreation, and charitable donations? And more importantly, how much money can be devoted to savings for that inevitable rainy day? Each of these factors makes creating a monthly budget frustrating and often confusing, and when we extend that over the course of a year the tension really mounts. But other financial concerns also shape the family budget. Most people have a fairly good handle on the necessities, and are well aware of the monthly costs of their rent or house payment, their utilities, and even their food costs. Within the cell that says ‘Congratulations! Your budget is balanced within 5%!’ this wording will change based on the user’s information, as this statement is dependent on the numbers that the user enters into their budgeting template.Creating a workable family budget can be difficult, and it's sometimes hard to know exactly where the money is going.

Within the four cells that contains ‘$0’, this amount is automatically calculated for the user based on the information that user enters within their budgeting template. This cell is meant to be selected by the user. Within the cell that says ‘Every Month’, there is a small grey drop-down button to the right of the words ‘Every Month’. The diagram is a screenshot of the “Balancing Your Budget” table within the budgeting template.

0 kommentar(er)

0 kommentar(er)